kentucky property tax calculator

A citys real estate tax regulations should comply with Kentucky constitutional rules and regulations. Kenton County has one of the highest median property taxes in the United States and is ranked 783rd of the 3143 counties in order of median property taxes.

Jefferson County Ky Property Tax Calculator Smartasset

Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation.

. The median property tax on a 13190000 house is 94968 in Kentucky. Yes I have. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Meade County.

Overview of Kentucky Taxes. However these rates only apply to wages salaries and other forms of compensation for employees in the state. Property not exempted has to be taxed equally and consistently at present-day values.

DORs online inventory tax credit calculator has the capability to track numerous separate locations. The exact property tax levied depends on the county in Kentucky the property is located in. All rates are per 100.

State law - KRS 132020 2 - requires the State real property tax rate to be reduced anytime the statewide total of real property assessments exceeds the previous years assessment totals by more than 4. Additionally you will find links to contact information. For this reason cities should be aware of what they can and cannot tax within their jurisdiction.

This calculator will determine your tax amount by selecting the tax district and amount. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys.

The tax estimator above only includes a single 75 service fee. It is levied at six percent and shall be paid on every motor vehicle used in. Please note that this is an estimated amount.

The median property tax on a 13190000 house is 138495 in the United States. Therefore retirees will not be on the hook for these taxes. KRS 132220 1 a.

If you dont know your assessment value or tax district please look it up here using your address. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1st of each year. The city establishes tax levies all within the states statutory directives.

The median property tax in Kenton County Kentucky is 1494 per year for a home worth the median value of 145200. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property. Oldham County collects the highest property tax in Kentucky levying an average of 224400 096 of median home value yearly in property taxes while Wolfe County has the lowest property tax in the state collecting an average tax of 29300 054.

Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate. The median property tax on a 14520000 house is 149556 in Kenton County.

Average Local State Sales Tax. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. State Real Property Tax Rate.

The median property tax on a 14520000 house is 152460 in the United States. Kentucky homeowners pay 1257 annually in property taxes. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The median property tax on a 10770000 house is 113085 in the United States. Kentucky has a flat income tax of 5. The median property tax on a 13190000 house is 84416 in Hardin County.

The median property tax on a 14520000 house is 104544 in Kentucky. Owners rights to timely notice of tax levy hikes are also obligatory. Different local officials are also involved and the proper office to contact in each stage of the property tax cycle will be identified.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. This calculator uses 2021 tax rates. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. The median property tax on a 10770000 house is 77544 in Kentucky. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property.

Actual amounts are subject to change based on tax rate changes. For example the sale of a 200000 home would require a 200 transfer tax to be paid. Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected.

Various sections will be devoted to major topics such as. The Kentucky Department of Revenue is required by the Commonwealth Constitution Section 172 to assess property tax at its fair cash value estimated at the price it would bring at a fair. Therefore the DOR Inventory Tax Credit Calculator is the best tool to correctly compute the tax credit.

FY 2021 Kentucky city property tax rates Excel 2021 City Property Tax. Maximum property tax levels also vary based on the size of the city and House Bill 44 1979 placed strict limits on raising property tax rates from year to year. Kentucky charges local occupational taxes on the county and city level.

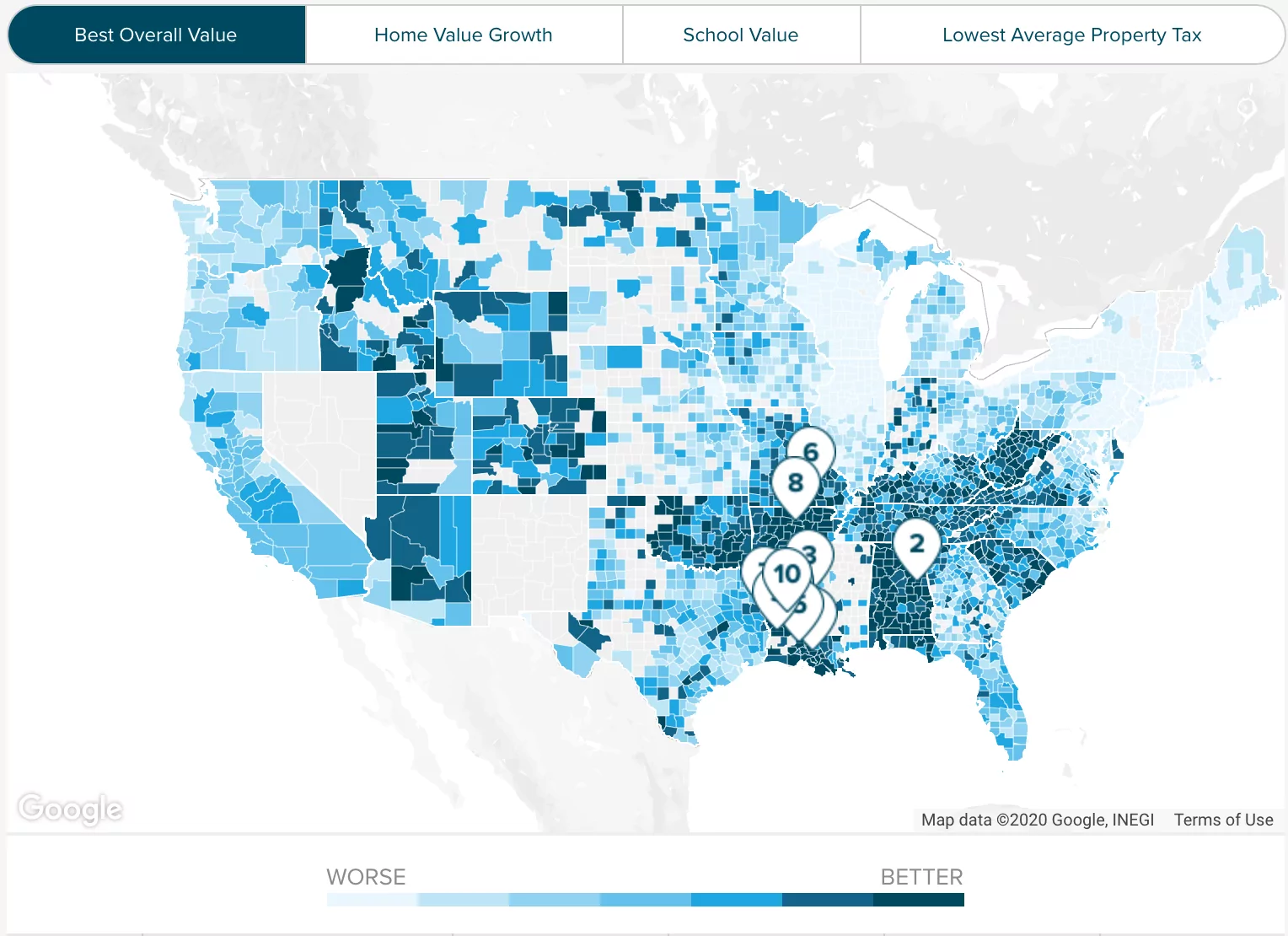

How high are property taxes in Kentucky. Kenton County collects on average 103 of a propertys assessed fair market value as property tax. Maximum Possible Sales Tax.

The assessment of property setting property tax rates and the billing and collection process. That rate ranks slightly below the national average. Both sales and property taxes are below the national average.

For comparison the median home value in Kentucky is 11780000. Payment shall be made to the motor vehicle owners County Clerk. At the same time cities and counties may impose their own occupational taxes directly on wages bringing the total tax rates in some areas to up to 750.

If you are receiving the homestead exemption your assessment will be reduced by 40500.

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

States With Highest And Lowest Sales Tax Rates

Kentucky League Of Cities Infocentral

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

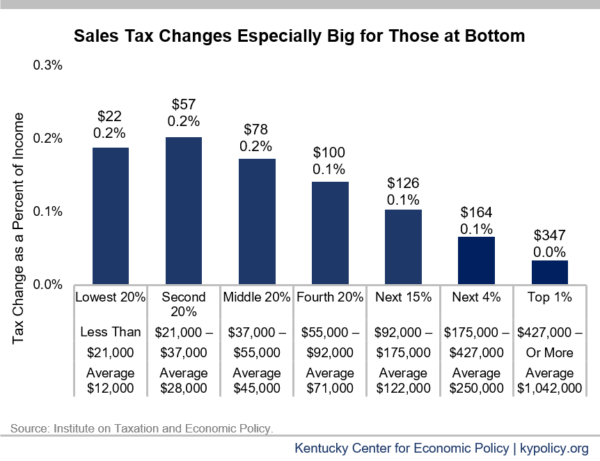

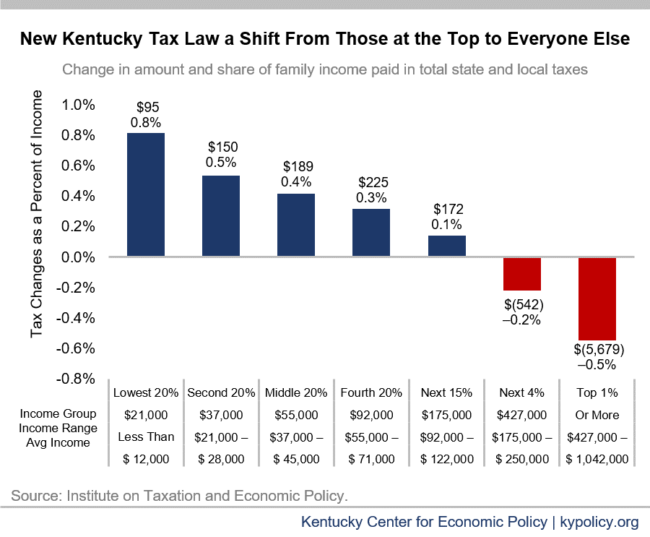

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Property Tax Calculator Smartasset

Chart 50 Highest Real Estate Tax Levies By Kentucky School Districts 89 3 Wfpl News Louisville

Tax Calculator Mccracken County Pva Bill Dunn

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

Kentucky Property Tax Calculator Smartasset

North Central Illinois Economic Development Corporation Property Taxes

Kentucky Property Tax Calculator Smartasset

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy